Why Tariffs WILL NOT Cause Inflation

America prospered under Tariffs for 150 Years—the Free Trade Experiment Failed

President Trump’s Liberation Day tariffs are not just about reshoring industry & creating middle class jobs—this is about restructuring America’s entire economy from consumption to production—from taking to making.

The economic logic behind this goes all the way back to Adam Smith’s ‘Wealth of Nations’ & Alexander Hamilton’s ‘Report on Manufactures” which explain countries get rich: increased productivity and capital accumulation. Nevertheless, most economists & media personalities say this won’t work.

There’s a lot of fearmongering about tariffs. In this article I will debunk the argument: “tariffs will cause inflation”.

Asleep at the wheel

First, we must admit there will be short-term pain while the market adjusts. This happens any time there’s a big policy shift. I bet the media would throw a fit if President Trump ended income tax—“GDP will shrink by $250 billion as tax accountants are put out of work, how will America ever recover?”

In the long-run, tariffs will not cause inflation. We can come to this conclusion in two different ways. First, let’s look at economic history. President George Washington’s first major piece of legislation was the Tariff Act of 1789. Tariffs were imposed to raise revenue & to promote domestic manufacturing.

Tariffs were raised significantly after the War of 1812, and remained high throughout the 1800s. In fact, America had THE HIGHEST average tariff rate in the Nineteenth Century—it’s not a coincidence this is when the US industrialized. By 1945 America was the world’s factory, making half of all manufactured goods. During this time—while tariffs were high—the cost of living decreased significantly.

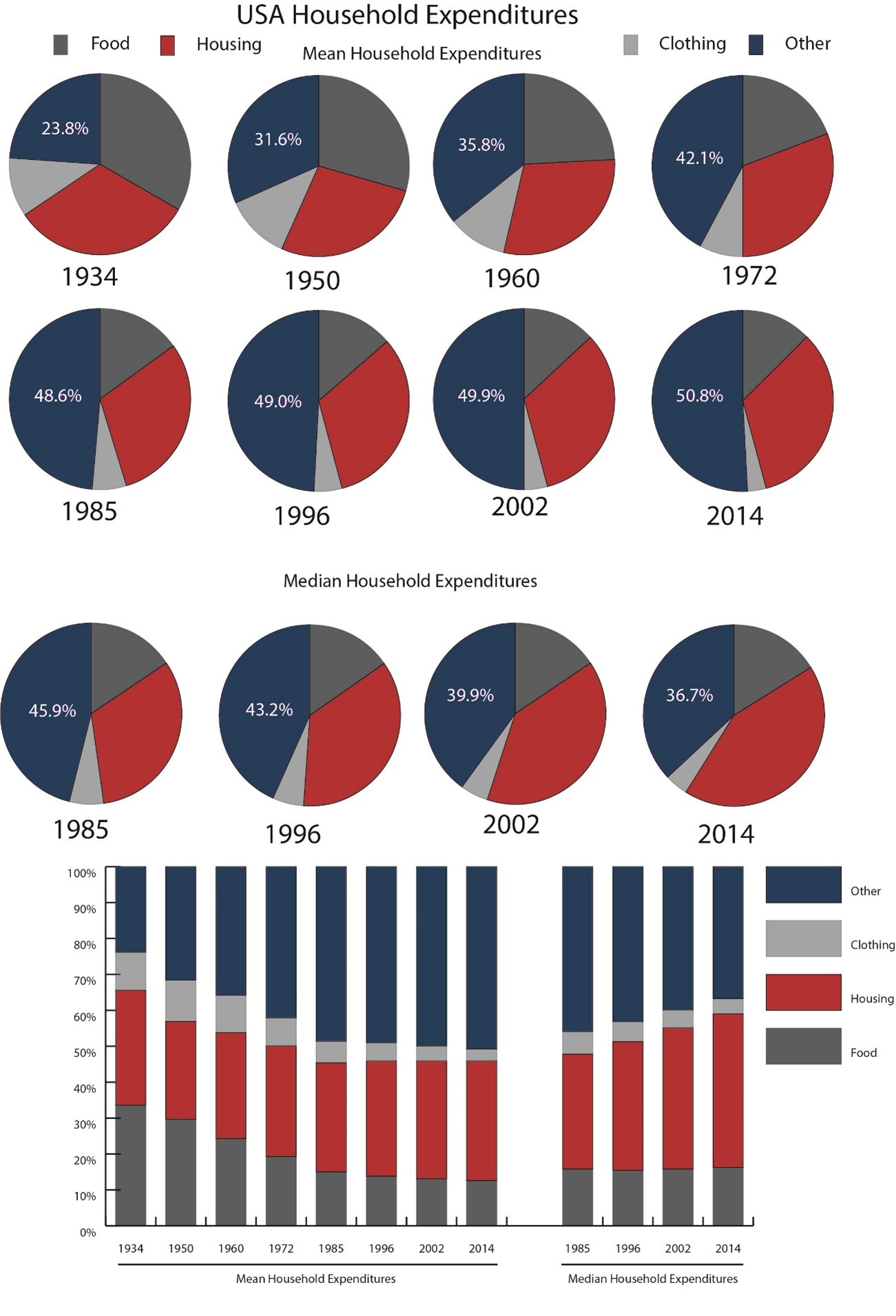

This continued into the 1900s. At the end of this post I have included a graph which shows the decline in the median American family’s purchasing power. You can see that the fraction of spending on wants increased until the 1980s & then decreased. What changed? America began the “free trade” experiment—economic globalism packaged with a libertarian-sounding name.

Since 1974 the ordinary American’s purchasing power has decreased—the cost of living increased. This is exactly THE OPPOSITE of what the media claims. “Cheap” goods aren’t so cheap when you’re unemployed, or competing for wages with people in China or Mexico.

Second, the economic logic tells the same story. Tariffs are taxes on imports, which can be avoided entirely by buying American. This creates a strong incentive for foreign producers to lower their costs: if countries like China or Mexico want access to America’s market—which they do—then they will have to find a way to reduce their costs to balance out the tariff. Lower global production costs benefits everyone.

At this point, critics argue that even if you buy American, you will still end up paying more. Why? American goods cost more to begin with, and without foreign competition, American businesses will price-gouge.

Maybe in the short term, but not in the long term. America’s manufacturing industry is among the most productive in the world. Given that productivity is what ultimately drives prices, America’s manufactured goods should also be among the cheapest in the world.

The issue is that prices are skewed by “externalities”, foreign currency manipulation, and predatory trade practices. This results in efficient and cost-effective American factories being closed, while inefficient foreign factories—in places like Italy and Germany—remain open for business. Protecting American markets from abuse will help our domestic free market function more efficiently, rather than pitting American businesses against state-backed foreign rivals. This will lower costs as the market adjusts to the new normal.

Tariffs will also reshore American factories and thereby increase domestic output. Manufacturing is an interesting industry, because prices are subject to the law of “increasing returns.” That is, the more that we manufacture, the lower the price of each unit of production becomes. This is because capital costs are fixed, and the more we make, the more these costs are disbursed. As such, there is good reason to expect that prices of American products will actually decrease after the market adjusts to tariffs.

What is seen and what is unseen

Despite allegedly caring about consumer prices, the media conveniently forget that economic globalism causes inflation of a different kind.

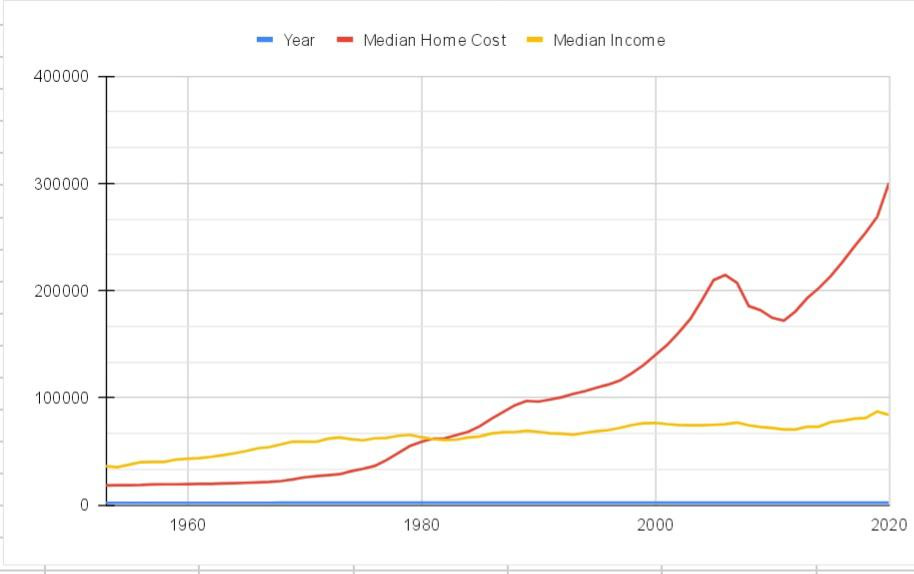

Remember, America imports far more than it exports. This results in a trade deficit which we need to pay for. How? By selling assets and debts. As a result, the trade deficit directly contributes to the increase in prices—inflation—of American assets and debts. For example, in 2024 foreigners bought an estimated $42 billion of residential real estate, $8 billion of agricultural land, and $12 billion commercial real estate.

This drives up real estate prices, locking our own young people out of the real estate market—denying them their share of the American Dream.

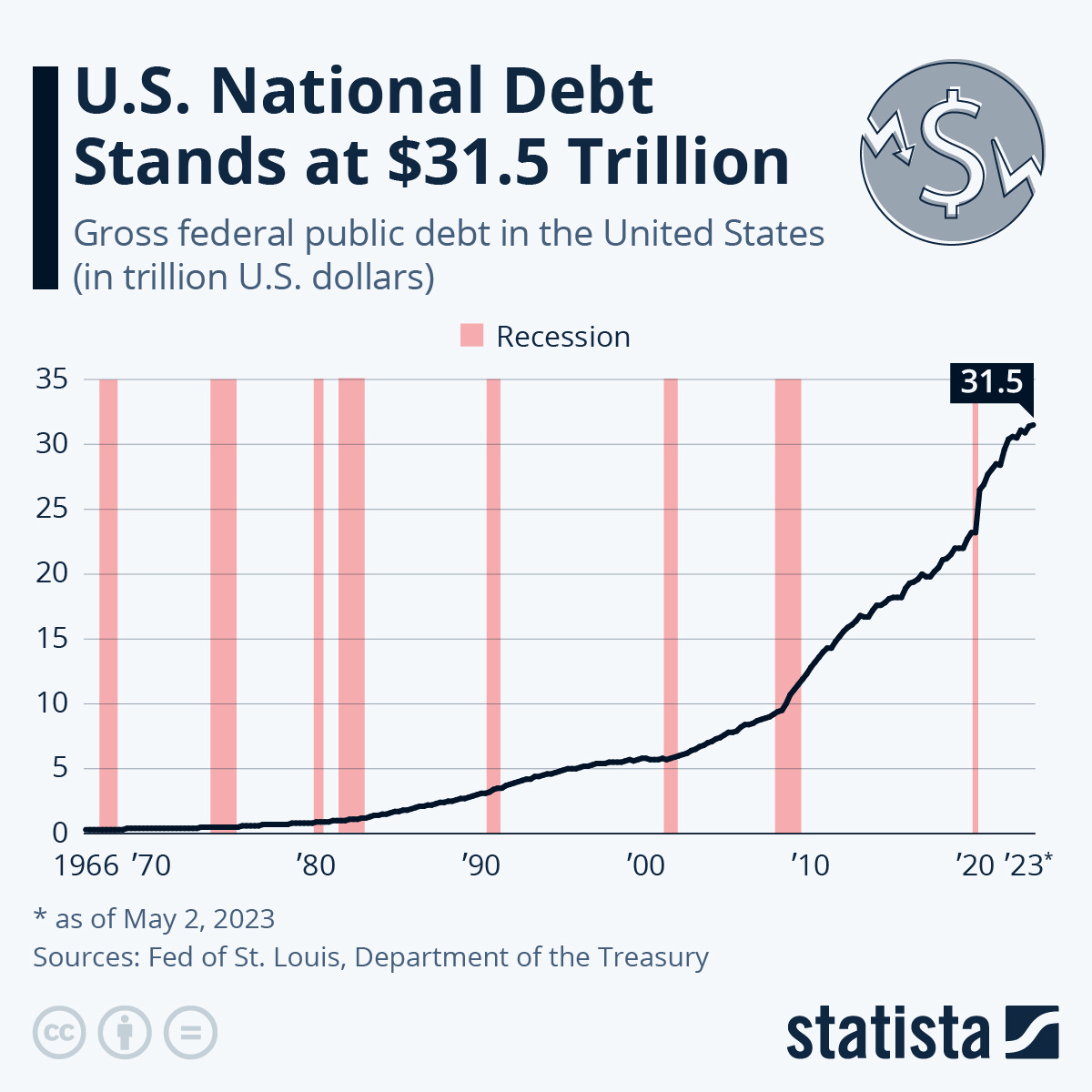

America also trades debt. This is sort of like buying groceries on our credit cards, except is occurring at the national level. For example, foreigners own some $8.67 trillion of U.S. Treasury securities, accounting for 24 percent of the public debt. Further, America’s corporate and household debt has ballooned since 1973 to the highest levels since World War 2.

Debt is especially dangerous because we have to repay the principle and we pay interest. This inflates the cost of buying foreign products in a way that most economists fail to appreciate. Consider that America became a debtor nation in 2006—for the first time since the Great Depression. As a result, we are now paying over $150 billion in interest every year to foreign entities for the privilege of buying the products we should be building.

As you can see, tariffs will not increase the costs of goods in the long run. If anything, the price of goods should begin a slow and steady decline—exactly what happened in America for almost 2 centuries under high tariffs.

Additionally, I hope you see that the whole question is framed disingenuously: the current system creates inflation—it’s just harder to see because it’s hidden in asset prices & the debt burden.